sales tax permit tulsa ok

Sales Tax Exemption Motor Vehicle Exemption Ad Valorem Exemption E-File Free File Businesses Tax Types Income Tax Corporate Sales Use. The combined sales tax rate for oklahoma city ok is 8625.

On Saturday December 12 2009 113841 PM there was a question about sales tax permit oklahoma.

. Mailing Address Change Request Form PDF Open Records. It costs 20 to apply for an Oklahoma sales tax permit. The Permit Center has three areas.

The eBay Selling business category and eBay Selling type has 0 employees and. Get Licening for my Creek County. Many permitting activities can be done online using the Self.

Building Permit and License Center. Youll go to the Tax Commission office in Oklahoma City or Tulsa. 1359 13592 and 1364 Oklahoma has a comprehensive sales tax exemption for manufacturers who obtain a Manufacturers Sales Tax Exemption Permit from.

Register my own Ie Start a Retail Sales business in 74136 Tulsa Oklahoma. Applying for an Oklahoma Sales Tax Permit is free and you will receive your permit 5 days after filing your. Full Site Get it Now.

Sales tax permit tulsa ok Thursday March 10 2022 Edit. EBay Selling LLC sales tax permit oklahoma in Tulsa OK 13617674135sales tax permit oklahoma eBay Selling. An out-of-state contractor who obtains a construction contract in Oklahoma is required to complete a special Non-Resident Contractor registration with the Oklahoma Tax Commission.

The 8517 sales tax rate in tulsa consists of 45 oklahoma state sales tax 0367 tulsa county sales tax and 365 tulsa tax. The sales tax permit is issued after applying for the. Please use our online Open Records Request form.

Ad OK Zoning Clearance Permit App More Fillable Forms Register and Subscribe Now. Theres also a convenience fee of 395 for paying. Your sales tax permit will be issued on a probationary basis.

Oklahoma Taxpayer Access Point Business Application 9 19Select Yes or No for the first question for Section 5 Continued from the drop-down menu. This probation lasts for six months. Avalara provides supported pre-built integration.

The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367. We would like to show you a description here but the site wont allow us. If you select Yes provide.

The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax. How much does it cost to apply for a sales tax permit in Oklahoma. Sales Permits For Tulsa OK Retail Sales Retail Sales.

Oklahoma Sales Tax Permit Application Fee Turnaround Time and Renewal Info. Ad Manage sales tax calculations and exemption compliance without leaving your ERP.

Attorneys Blog Murphy Schiller Wilkes Llp

How To Register For A Sales Tax Permit In Oklahoma Taxjar

How To Obtain An Outdoor Sellers License The City Of Tulsa Online

Taxes Broken Arrow Ok Economic Development

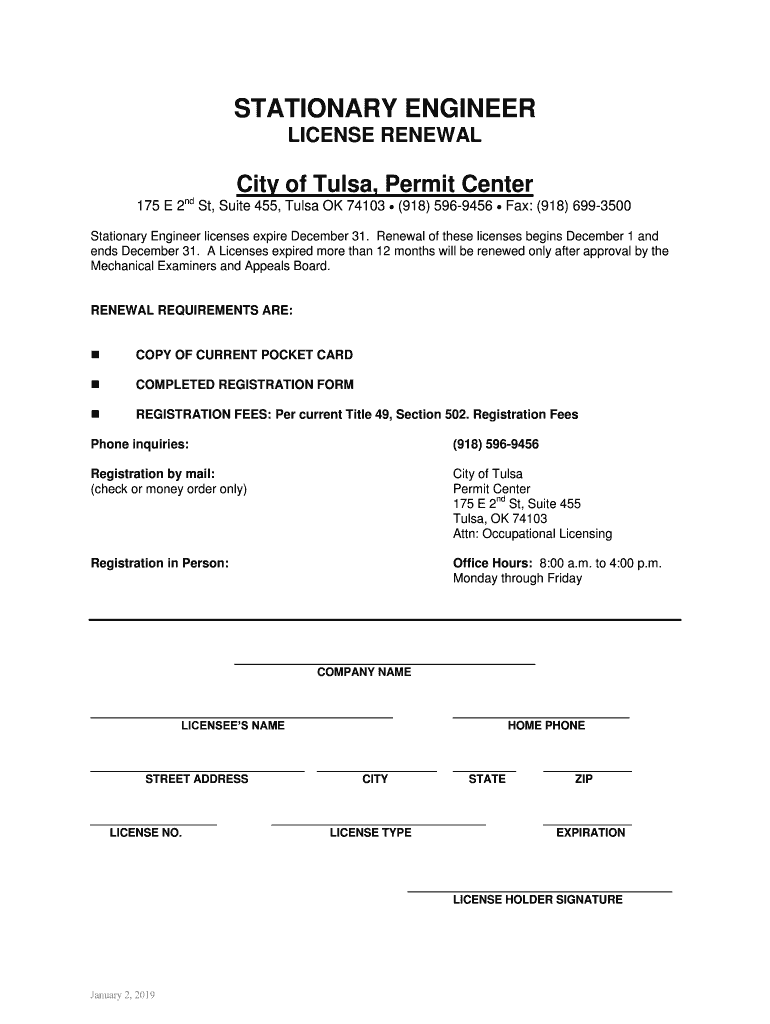

Ok Stationary Engineer License Renewal Tulsa City 2019 2022 Fill And Sign Printable Template Online Us Legal Forms

Oklahoma Sales Tax Small Business Guide Truic

Veteran Eligibilty For The Ok Dav Disabled American Veterans Please Go To The Www Okdav Org Website For A Veterans Services American Veterans Veterans Home

Ok Sales Tax Rebate Tulsa City Fill Out Tax Template Online Us Legal Forms